Europe Fintech Funding Trends

The fintech industry in Europe is currently navigating through turbulent waters as the flood of investment seen during the pandemic has notably receded. This downturn in funding has forced many fintech companies to reassess their strategies and financial projections, leading to a more grounded approach compared to the ambitious plans set during the high of the pandemic.

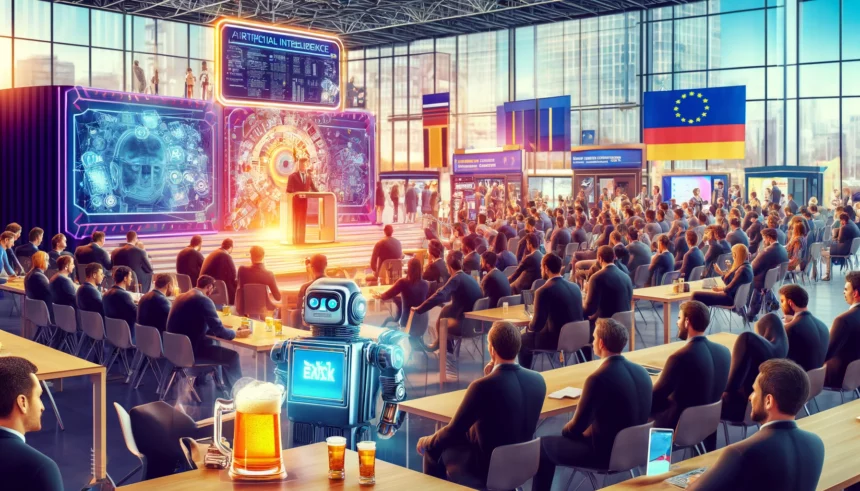

Mixed Sentiments at Amsterdam Fintech Conference

At the heart of the financial technology conversation this week was the Money20/20 conference held in Amsterdam. The atmosphere was a mix of cautious optimism and realism about the future. While onstage discussions were often buoyant, with AI and new technologies taking center stage, the undertone among the attendees reflected the broader challenges facing the sector. Damien Dugauquier, co-founder of iPiD, highlighted the difficulties in raising funds in Europe, a problem he attributes to the region’s slower economic growth compared to the U.S. and Asia.

Shift Towards Realism in Valuations

Despite the gloom over funding, there were positive takes on the situation. Experts believe that the fintech sector is slowly adapting to the new economic reality. With central banks across the globe hiking interest rates to combat inflation, the days of easy money have halted, prompting fintechs to tighten their belts and focus on sustainable growth. Helene Falchier of Portage Ventures noted a significant shift in company founders’ expectations, who are now valuing their companies more realistically.

Venture capital investment in European fintechs saw a sharp decline, with figures from PitchBook indicating a drop from $26 billion in 2022 to just $9.2 billion in 2023. Despite these sobering numbers, some attendees were hopeful, citing the resilience and adaptability that many companies have demonstrated.

A Glimpse of Recovery?

There are glimmers of hope for a recovery as some companies at the conference reported stabilizing their finances and even moving towards profitability. Monica Long of Ripple remarked on the vibrancy of the crypto sector in Europe, which seems to be performing better than in other regions. Moreover, companies like Monzo have started to show profitability, which bodes well for their future prospects.

The consensus among many experts is that as interest rates might eventually lower, and with it, a more favorable funding environment could emerge. This could lead to increased IPO activity and more mergers and acquisitions in the fintech space, as suggested by Kunal Jhanji of Boston Consulting Group.

In conclusion, while the European fintech sector may not be at the peak of its pandemic-era boom, the industry is learning and adapting. The focus now is more on sustainable growth and profitability rather than unchecked expansion. With some signs of recovery on the horizon, there remains a cautious but tangible optimism among Europe’s fintech leaders.